An extended-term pattern which is constant, is that the US is working forward of Europe when it comes to prosperity. In 2024, the US economic system grew by 2.8 %, in line with the World Financial Outlook, in comparison with merely 0.8 within the Euro space. In 2025 the hole will cut back considerably, however the US remains to be anticipated to develop its economic system by a proportion level greater than the Euro space. In 2029, the US economic system remains to be anticipated to develop at 2.1 % in comparison with 1.2 % within the Euro nations.

A technique of taking a look at it’s that we reside in a time of continued urbanization and inhabitants demise, traits that are obvious all through the world – but the US is faring higher than Europe when it comes to demographics. A worldwide comparability suggests {that a} key cause is the distinction within the tax burden, with the US rising extra because of a decrease burden.

Taxes have an effect on the choice of skills, entrepreneurs, firms and traders. Significantly excessive expert folks are inclined to choose low tax jurisdiction. Demographic challenges exist in low tax in addition to in excessive tax international locations, however the problem of prosperity progress is way harder for top tax nations to sort out.

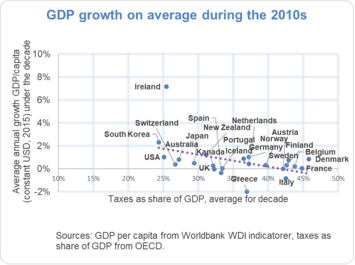

Certainly, it was the worldwide sample in the course of the 2010s, that superior international locations with decrease tax burdens had extra financial progress. Eire had for instance a mean of seven.2 % annual progress throughout this era, because of low taxes and enterprise pleasant laws attracting overseas corporations and boosting native enterprise progress. Many excessive tax European economies have nevertheless throughout this era, had restricted and even destructive progress of GDP per capita.

It’s related to know that the worldwide sample proven for the 2010s just isn’t distinctive. Throughout the 2000s, the Nineties, the Eighties and the Seventies superior international locations with decrease tax burdens had extra financial progress on common. By adopting free markets and low taxes, international locations reminiscent of South Korea and Eire, have been capable of improve prosperity considerably over the past 5 many years.

The comparability of mind enterprise jobs – a time period for the share of the working-age inhabitants throughout Europe employed in extremely knowledge-intensive enterprises – reveals how the data geography is shifting inside Europe.

Eire, Netherlands and Malta with business-friendly insurance policies and taxation are quick climbers when it comes to the data intensive jobs of Europe. These international locations thrive in mind enterprise jobs progress since they’ve aggressive taxation prices for traders, companies and labor. They’re additionally progressing in human capital, with Eire and Estonia having amongst the very best college outcomes on the earth, in line with PISA. The Netherlands, which has a average taxation degree and enterprise pleasant insurance policies, is also amongst the climbers.

The hyperlink between financial progress and tax fee has existed for the final 5 many years, and in line with observations by main economist reminiscent of Ibn Khaldun and Arthur Laffer, is a typical theme in human civilization. An essential level is that prime tax and massive authorities insurance policies throughout a time of inhabitants progress can crowd out progress, however nonetheless be in some way manageable because the underlying progress ranges are excessive. Now that we reside in a time of demographic decline and continued fast urbanization, the significance of boosting progress turns into much more essential.

To keep away from stagnation in coming many years, it’s sensible to deal with limiting the burden of taxation and the crowding out impact of enormous interventionist governments. Excessive taxes are what holds Europe again in comparison with the US.

But, this isn’t a function of Europe as an entire, simply the large lumbering economies with an excessive amount of paperwork and state intervention within the economic system. EU nations with low taxes that create incentives to work, and rising human expertise swimming pools, are estimated to even outpace the US in lengthy phrases progress.

In 2029, in line with the World Financial Outlook, the US progress of two.1 % can be nonetheless considerably larger than 1.2 % within the EU space. However the US can be outpaced by many particular person EU nations. This consists of Eire, Luxembourg and Slovakia (2.3 %), Slovenia and Latvia (2.5 %), Croatia (2.6 %), Cyprus (3 %) and Malta (3.5 %).

After all, these are simply estimates of the longer term to come back, however the conclusion remains to be related. If the big European economies are bored with stagnating, they should shift course in financial coverage. Why not study from these EU nations with smaller authorities sectors and fewer taxations, which prosper by permitting personal enterprise to thrive.

Nima Sanandaji, Director, European Centre for Entrepreneurship and Coverage Reform (ECEPR)

Chart: courtesy the creator.