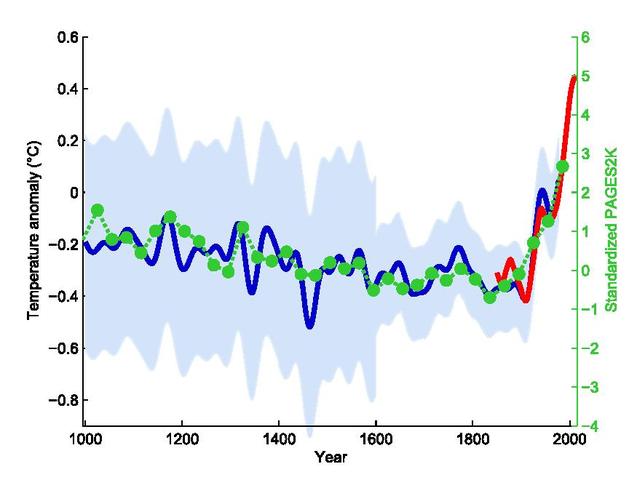

In 2005, Scientific American printed an article saying that the hockey stick graph printed a couple of years earlier by Michael Mann, an educational who now works on the College of Pennsylvania, had change into “an iconic image of humanity’s contribution to world warming.” The article continued, saying the picture, which exhibits a looming spike in temperature, has change into “a focus within the controversy surrounding local weather change and what to do about it.”

That was an understatement.

Mann and the hockey stick have change into defining examples of the politicization of local weather science. The hockey stick performed a distinguished position in Mann’s defamation lawsuit in opposition to writer and journalist Mark Steyn. Final yr, a jury in Washington, DC, awarded Mann $1 million in that case. Through the trial, Canadian journalist Terence Corcoran declared the hockey stick has change into “a robust and efficient piece of supposed proof for makers of local weather coverage and a near-religious icon that activists proceed to revere.”

That is the hockey stick graph Mann et al. printed in 1999. Credit score: Wikipedia

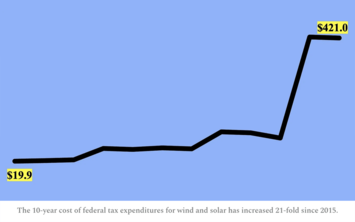

Whereas scientists and journalists can argue about Mann’s hockey stick, his strategies, greenhouse fuel emissions, and temperature forcings, there will be no argument in regards to the staggering value of the subsidies Congress has given to Massive Wind, Massive Photo voltaic, and different alt-energy outfits within the identify of local weather change. In late November, the Treasury Division printed the most recent version of its annual report on tax expenditures, which it says are “income losses attributable to provisions of Federal tax legal guidelines.”

What do these Treasury stories present? A hockey stick.

The Inflation Discount Act, which turned regulation in 2022 because of a single vote forged by Kamala Harris, has was a run on the Treasury. As seen on the prime of this text, the IRA has fueled a hockey stick of gradual — after which exploding — federal tax expenditures for the funding tax credit score and manufacturing tax credit score. These credit, that are the principal drivers behind the deployment of wind and photo voltaic power, and a handful of different types of alt-energy, are, by far, the most costly energy-related provisions within the federal tax code. Between 2025 and 2034, the ITC and PTC will account for greater than half of all energy-related tax provisions. And that complete doesn’t embrace the tax credit for electrical automobiles.

Learn the remainder of this piece at Robert Bryce Substack.

Robert Bryce is a Texas-based writer, journalist, movie producer, and podcaster. His articles have appeared in a myriad of publications together with the Wall Road Journal, New York Instances, Forbes, Time, Austin Chronicle, and Sydney Morning Herald.

Picture: courtesy Robert Bryce Substack.